Contrast the Accounting and Economic Concepts of Income

An Overview Profit is one of the most widely watched financial metrics in evaluating the financial health of a company. Taxable Income Taxable income is regulated by the definitions of the US.

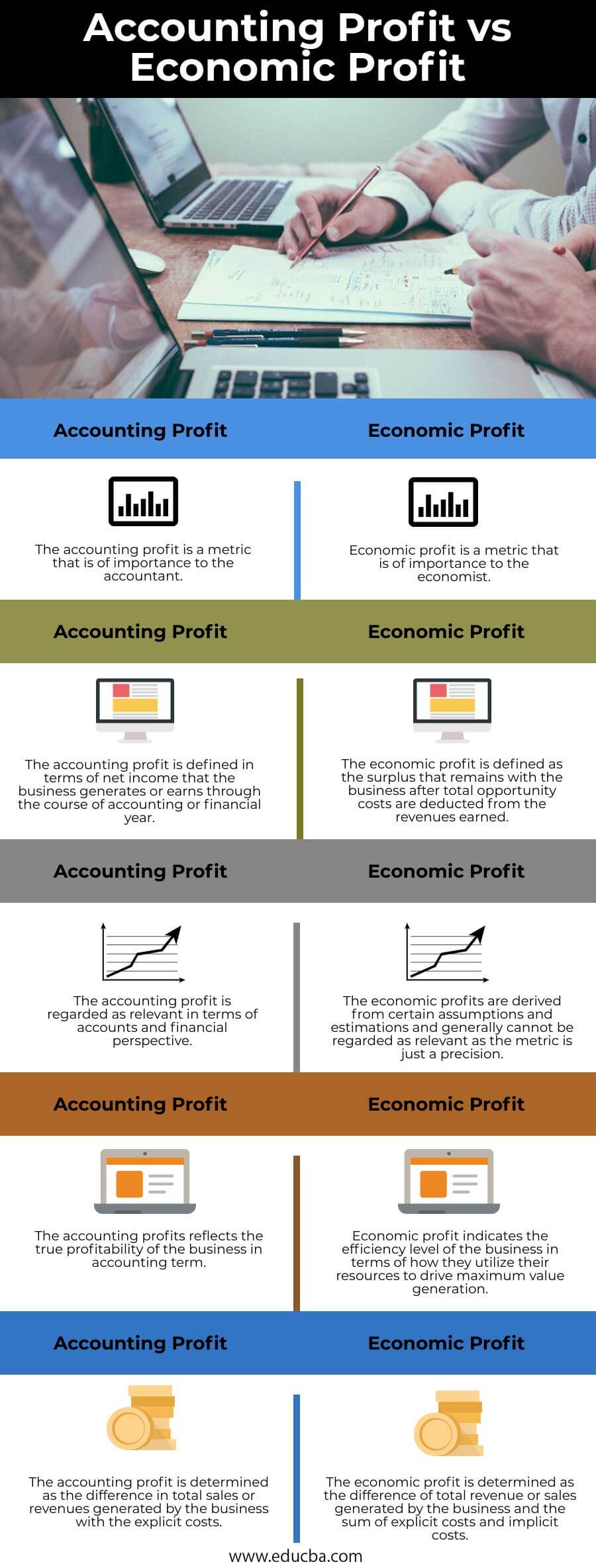

Accounting Profit Vs Economic Profit Top 5 Differences To Learn

Accountants define income as the amount that an individual could consume during a period and remain as well off at the end of the period as he or she was at the beginning of the period.

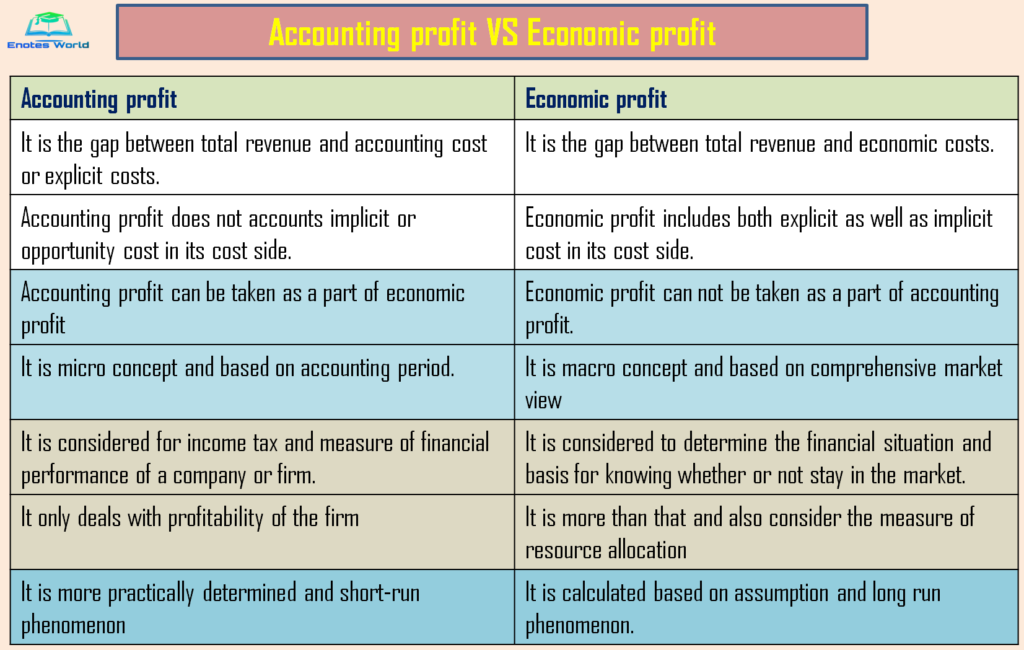

. Accounting profit and economic profit share similarities but there are distinct differences between the two metrics. On the other hand. Economic income is based on valuation of anticipated future benefits while accounting is historical and transaction based.

-a- Stock -ea- Q2 ___ variable are time dimensional. Accounting Income vs Economic Income Definition Accounting income or loss recognizes realized gains and losses and does not recognize unrealized gains and losses. Internal Revenue Service IRS or the corresponding tax authority of income or expenses and it does not necessarily match with the.

Economic Income economic approach is the increase in net worth net increase in asset values that has occurred during a period Accounting Income transactions approach is the result of certain activities that have taken place during a period. Economists define income as the amount that an individual could consume during a period and remain as well off at the end of the period as he or she was at the beginning of the period. The next step is to take the difference between the cash flows of each project and compare them to see which generates more economic profit.

We can analyse the difference between the present value or economic income and the accounting income using the previous example. The metric differs from gross income in that the latter accounts for only direct expenses whereas accounting income also takes into consideration all indirect expenses. While economic income is an exante income based on future cash flow expectations the accounting income is an ex-post or periodic income based on historical value.

Wherewithal to pay - a tax should be collected when the taxpayer can most easily pay exampled 15 year installment sale shouldnt have requirement to pay ALL taxes for total sale at once. Tax law has adopted accountants concept of income. In accounting income is measured by a transactions approach.

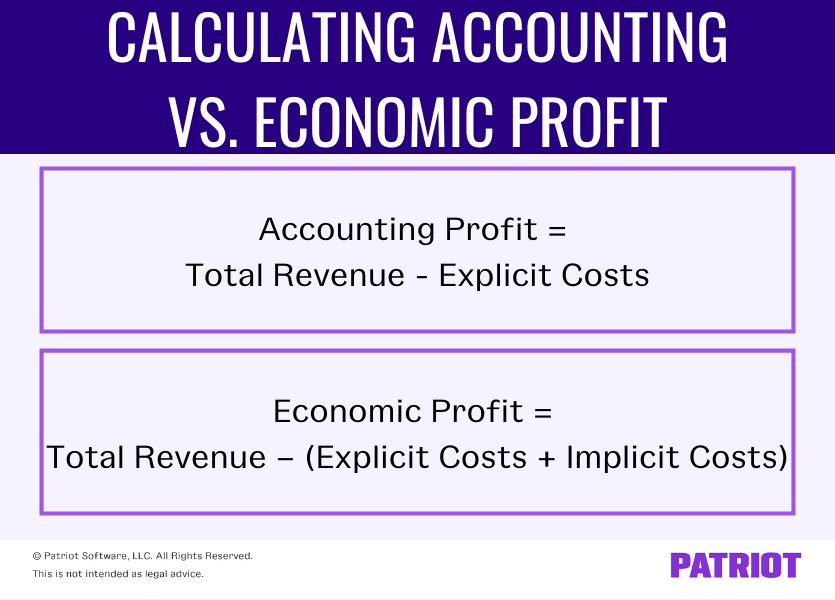

Financial accounting standards and the US. Accountants do not need economic cost information to create their income statement. Learn the formula to calculate each and derive them from an income statement balance sheet or statement of cash flows.

Should holding gains and losses be included in SNA income. Economic and Accounting Concepts of Income Created Date. For example accountants are not concerned if the company could have made N3 000 per month from leasing its equipment for a total of N36000 during the fiscal year- the N36 000 does not come out of the gross profit for the company.

Economists measure income when it is realized in a completed transaction. Key Takeaways Accounting profit the net income for a company which is revenue. Despite somedisadvantages hindering from its broader.

-a- Flow -ea- Q3 Real Flow is also known as ____. Accounting income is an income resulting from business transactions arising from the cash-to-cash cycle of business. The following are the differences between accounting income and economic income.

Administrative convenience - economic concept is considered too subjective 2. National Income of a country is a Stock Concept. When the related transaction is settled or completed gains and losses are realized.

Between economic and accounting concepts cost FAQwhat are the differences between economic and accounting concepts cost adminSend emailJanuary 2022 minutes read You are watching what are the differences between economic and accounting concepts. The accounting income recognises income only when they have been realised. It recognises benefit flows only when they are recognised while economic income recognises flows after they are received.

Gross income is realized meaning that a transaction took place and resulted in money-in-hand income. Several substantial differences exist between both concepts. Clarification of the income concept in the SNA Broadly this group of issues deals with the SNAs exclusion of holding gains and losses from income in contrast with business accounting standards and economic theory.

2 Accountants do not make any allowance in their method of valuation for change in purchasing power of money due to change in price levels. Accounting profit is the net income for a company which is revenue minus expenses. The paper tries to.

Economic profit is similar to accounting profit but it includes opportunity costs. Gains resulting from an actual business transaction. Ad_1 Economic Protif vs.

The paper outlines basic features of accounting and economic concept of income. GDP at basic prices. Economic income is an increase in the book value of an asset that is unrealized until a future transaction takes place.

-a- False National Income of a country is a Flow concept as it is measured over a period of time. This defines the difference of accounting earnings vs economic earnings. The Concept of income 1.

Economic income or loss recognizes all gains and losses whether realized or unrealized. Tax codes define gross income also known as accounting income. -a- Physical Flow -ea- Q4 State true or false with reasons.

Hicks for accounting purposes. The paper analyses the possibility of using the economic concept ofincome introduced by J. Accountants measure income when it is realized in a completed transaction.

As you can see Project 2 generates a positive economic profit relative to Project 1. This differs from accounting income which only recognizes realized gains. The main differences between economic and accounting income are based chiefly on value increments.

Economic income or loss recognizes all gains and losses whether realized or unrealized. 1 Economists income is subjective since its enumeration depends upon the ultimate benefits actually derived by individuals whereas Accountants income is objective since it depends on money-incomes.

Accounting Profit Vs Economic Profit Top 5 Differences To Learn

Law Of Supply And Demand Poster Zazzle Com Economics Poster Economics Lessons Law Of Demand

Economic Profit Vs Accounting Profit Video Khan Academy

Supply And Demand Economics Social Studies For Google Classroom Economics Lessons Teaching Economics Social Studies Worksheets

Money Banking And Monetary Policy Cheat Sheet By Kali Winn98 Download Free From Cheatography Cheatograp Monetary Policy Economics Lessons Economics Notes

Daily Infographic 10 Principles Of Economics You Should Know Economics Lessons Teaching Economics Economy Lessons

Accounting Profit Vs Economic Profit Definitions How To Calculate

Microeconomics Examville Economics Lessons Economics Notes Teaching Economics

Macroeconomics Vs Microeconomics Top 5 Differences Infographics Economics Lessons Micro Economics Teaching Economics

Ohhh Okay Now Econ 2000 Makes Sense Economics Humor Economics Lessons Economics Quotes

The Money Supply Measuring M1 M2 Datapost Teacher Resources Money Make More Money

Financial Structure Capital Structure Capitalization And Leverage Business Risk Financial Cost Of Capital

Difference Between Accounting And Economic Profit With Table Ask Any Difference

Macroeconomics Examville Economics Lessons Macroeconomics Teaching Economics

Relationship Between Economic And Business Profit

Applying Game Theory In Economics Essays Tutor2u Economics Game Theory Economics Lessons Economics

Elasticity Infographic Economics Lessons Microeconomics Study Teaching Economics

Comments

Post a Comment